What is a Legal Services Invoice?

An invoice for legal services is essentially a bill presented to clients by their law firm in exchange for legal work that the law firm has performed for the client. Legal invoices tend to include various elements, such as the amount of time spent on a case, the rate the client is being charged (which may or may not be standard) , the type of legal work that is being performed and any additional costs that are being charged to the client – such as the costs of filing forms with the court or paying court filing fees.

Invoices for legal services are important for both lawyers and the clients they represent because they provide clarity and transparency in the legal services currently being performed or provided for a matter. Standard components generally included in an invoice for legal services are:

When clients receive an invoice for legal services, they can feel secure in the knowledge that a clear and concise record of the specific legal work that is being done on their behalf is always available.

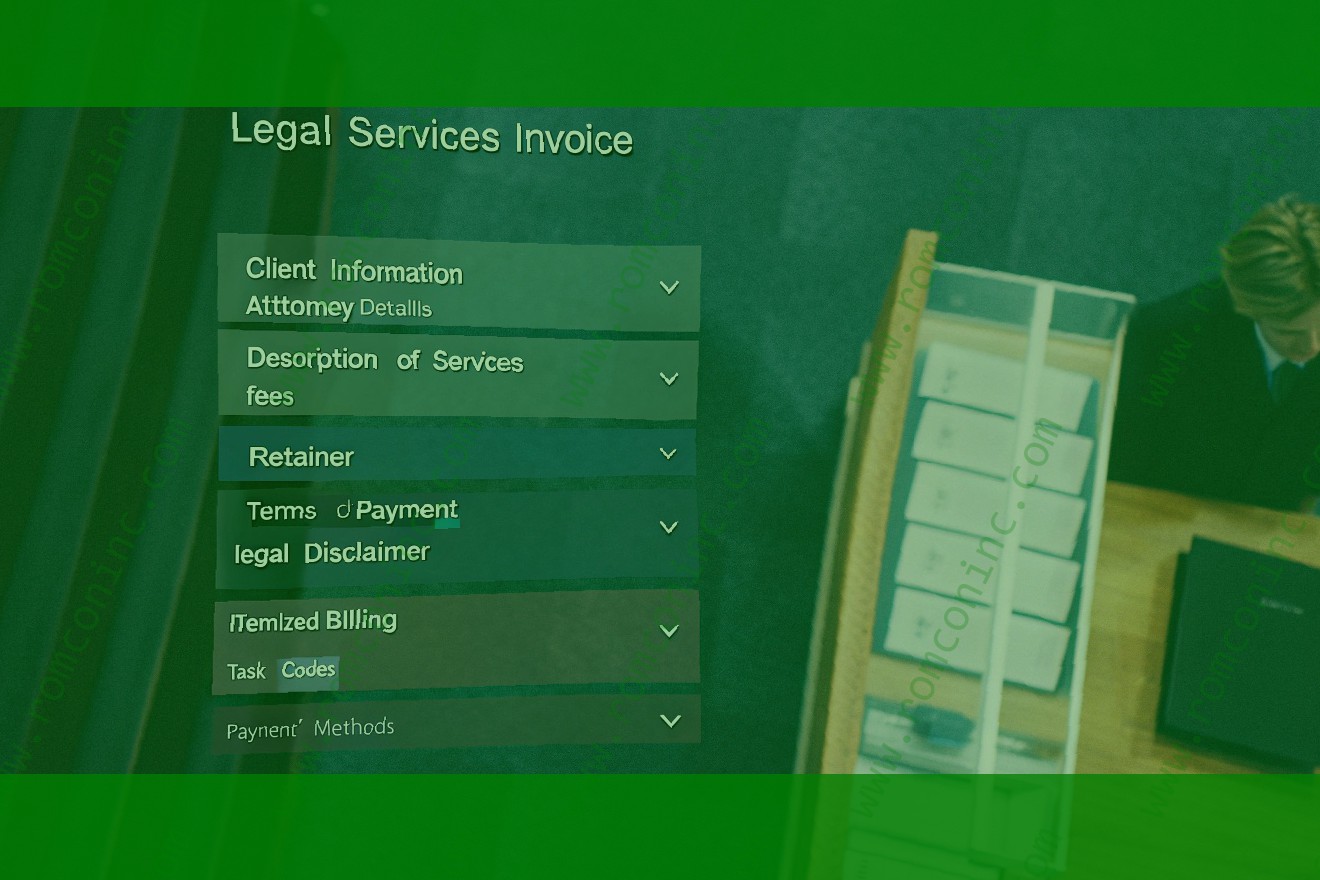

Major Components of a Legal Services Invoice

A law firm invoice is usually comprised of the following components:

Client Information:

The client information section is not required in order to comply with IOLTA regulations, however it can be useful to help quickly identify the appropriate client matter for payment processing. Client information typically includes the client name, address, telephone number, fax number, email address, and contact person. This is a section which candidates for automation, if such an option is available in the software you are using.

Attorney Information:

This section usually contains the full name of the attorney who performed the legal services and their billing rate. The billing rate is the same as the client fee. It may also contain identifying information for an administrator, paralegal, or other person who issued the invoice.

Description of Services:

This section describes the services that were rendered by date and by type of service or task. Automated computer systems often provide a method of inputting the data to be printed here, to be linked to the task codes, and then displayed in a readable manner to which the client will easily relate. Commonly these task codes include litigation, bankruptcy, intellectual property, employment, and corporate. This is generally a useful section; computer assistance is helpful when managing multiple matters across multiple different areas of the law.

Fees:

The amount owed on an invoice may be itemized by task code and assigned to the relevant date, message or service provided, each of which is then multiplied by the attorney’s or paralegal’s billable hours for that service or work. Fees is a generic term that may also include costs.

Retainer:

Some retainer agreements permit the prepayment of anticipated legal fees. When such a retainer is received it is essential to place the total deposit amount in the appropriate line item on the invoice. That amount will be subtracted from the amount due on the next invoice. Depending on how many retainer invoices are being sent out each day, week or month, it may be very difficult to recall all the applicable retainer amounts, or to assign them to the correct client matters.

Terms of Payment:

Payment is usually expected within 30 days of receipt of the invoice, at which point the unpaid balance may have accrued some level of interest. The terms of payment section usually specifies the method of payment, typically either check, wire transfer, or credit card payment. A coupon is often attached to the invoice for return with the payment. These are simple 2×2 inch slips of paper with blanks for the client’s invoice number, date, amount, and amount enclosed. These coupons and their use are useful for reducing time spent checking payments against invoices and in monitoring the status of accounts receivable.

Legal Disclaimer:

The legal disclaimer section usually provides some type of legal protection for the lawyer in the event the law firm does not receive payment for the invoice. Most often the client must agree that the law firm has no further obligation to represent them unless and until they paid any amount specified on the invoice.

How to Craft a Legal Service Invoice

The invoice you create for your services is a reflection of your professionalism and attention to detail. You must always ensure you maintain both of these with your invoices. Presumably, your legal practice management software will make invoicing easy to track and prepare. It should list your services, time spent, and include notes you have added, which clarify the services rendered. To simplify the process to create a professional layout, you shouldn’t have to "reinvent the wheel" for every invoice. Preset invoices prompt you for the needs specific to your particular invoice and automatically fill in the rest of the details. Standard layout and design should be used so your clients easily recognize you as their lawyer and law firm. Addressing the client in a clear and concise way via an address block is the most common way to state who the invoice is being sent to. The attorney’s contact information should appear on the invoice, so the client can respond if they feel there is an error or they have a question. The contact information block should contain the attorney’s name, phone number, fax number, email, and website address. Similarly, the Block should contain the law firm’s name and address. If a paralegal completes the invoice, their contact information should also be added as a cc to the contact information block. Your contact information also may be within your letterhead and footer, depending upon the program you are using to create your invoices.

There must be an invoice number. The date of the invoice must be listed as well. Your law firm may want to use a sequence for invoice numbers that has meaning behind it or links them to the date, such as sequentially by month or sequentially by year. A due date must be included as well. In addition, there must be a complete description of services rendered. This is one of the reasons that many law firms will have their billing done on a month plus date or one time period removed basis. If a large charge is made, it should be itemized on separate paper as a "letter request for payment." After the original invoice is sent, a second copy can be sent later without the "letter" at the top and with an insertion of "Thank you for your prompt attention." If you do not annotate anything about your bill, it is likely to go unnoticed. In these hard economic times, it is essential that the top paragraph include: "Our records indicate that you have previously received our statement for the enclosed bill." Your records should follow our form and be a simple Excel spreadsheet showing bout how much time was given to each task. You might put that in during the time you are completing your notes for the work you did on that case. That way it is current. Most attorneys already believe they produce invoices that are professional and effective. For those attorneys who need help, cloud-based practice management could offer assistance in invoice creation. Online billing solutions often feature the option of custom branding and previews. This ensures that your clients see exactly what they need to see and avoid awkward questions about invoice changes. Cloud-based practice management solutions take the worry out of the hard aspects of maintaining your business. Most online solutions provide tips and tricks on how to effectively invoice.

Mistakes to Avoid with Legal Service Invoicing

Legal invoicing mistakes can be more than a simple hiccup; they can lead to serious trust and ethics violations and adversely impact your law firm’s cash flow. Let’s examine some of the more common mistakes and ways to avoid them.

Incorrect Payments

Misstatements of accounts or assumptions by your accounting team can lead to your firm inadvertently accepting payment for legal services that have not been provided yet. To avoid a trust breach, ensure that trust funds are only spent on already-acquired items, and all funds disbursed from trust and operating accounts are properly accounted for by both your law firm and your bank.

Narrative Description of Services

Failing to provide an adequate description of the services performed may not seem like a big deal, but it can be the difference between prompt payment and weeks spent waiting for the client to sort out inconsistencies. When describing the services performed, make it easy for the client by using wording that accurately depicts what was accomplished. Include details when appropriate. For example, "Spoke with Mike about his contract" is much less clear than "Spoke with Mike about itemizing his contract to reflect his requested changes per our meeting on May 6." If the client is unclear or has additional questions, you may need to spend additional time to sort out any confusion, which means you are working for free.

Incorrect Client or Matter Number

Invoicing for services rendered can be difficult enough. Even straightforward procedures like assigning a client or matter number seem like they should be a piece of cake – yet all too often, mistakes happen. Sometimes the staff member entering the data gets distracted, or the person reviewing it is not the same as the one who completed the original entry, and billing goes out with the wrong number . The result is a payment that cannot be properly assigned to the right client or matter account, which wastes time and can cause serious issues for the firm. Your law firm technology team should be able to automate this entire process for you so that human errors like this don’t have a chance of occurring. Additionally, when invoices are sent out with the wrong client or matter number, it puts the firm at risk of a trust breach.

Delayed Sending of Invoices

Best practices dictate sending invoices promptly after services are rendered. Delayed invoices can cause issues on two fronts. First is that sending the invoice as close to the services rendered as possible allows you to collect payment sooner rather than later. Not receiving payment for services within a reasonable amount of time leads to gaps in cash flow and makes it difficult for you to operate and pay your own bills. Second, delayed invoices can make clients believe that they do not need to pay for additional services until they receive a bill. This may seem obvious to you as the law firm owner, but clients often think differently. Sending the invoice promptly reduces the opportunity for the client to forget about the money owed, which results in faster payment for your services.

Common mistakes in law firms billing doomsday scenarios. These mistakes can have a negative impact on your trust accounting, your law firm finance, and your clients’ overall impression of your firm. The good news is that modern billing software can easily remove the threat of these common mistakes. Affordable and reliable, billing software is essential for legal firms and their financial health.

Handling Disputes Related to Legal Service Invoicing

Managing Disputes over Invoices for Legal Services

Mediation and arbitration are two possible ways of resolving any disputes regarding invoices for legal services. Both of those processes are private and, as opposed to court proceedings, are not matters of public record. Mediation is a negotiation/litigation hybrid. The goal is to reach a mutually acceptable outcome. An experienced mediator conducts a series of private meetings with the parties. Arbitration involves a dispute resolution specialist who listens to the arguments of both sides, hears evidence, and then decides the matter. Arbitration is akin to a non-jury trial. The important distinction to remember is that the decision reached in a mediation is not binding on either party. If a resolution is not reached in the mediation session, someone else does not make the decision going forward unless the parties agree to do so.

A common dispute over an invoice for legal services is whether a fee charged is "reasonable." ARPC 1.5 requires that an attorney’s fees be reasonable. But what defines reasonableness? ARPC 1.5 has no guidance on that point. The goals of the mediation process are to resolve the dispute amicably and to preserve the attorney/client relationship. A mediation can be invaluable in a situation in which the client is disputing both the amount of money which is due to the attorney and the quality of the service provided by the attorney. Both the mediator and the clients have a common interest in resolving the dispute in a peaceful and professional manner.

If the dispute is not settled, both parties need to have a clear understanding of the terms of the engagement letter that they entered into before the attorney started legal services. Both parties should also have a thorough understanding of the law firm’s billing procedures and policies. Were the terms of what services were to be performed and the payment of those services clearly spelled out in writing? Does the law firm provide its client with updated billing statements on a regular basis? If applicable, does the firm advise the client about the possible impact of a lawsuit on the payment of fees? The bottom line is that the law firm needs to have all its bases covered in a written engagement letter.

This is yet another reason why engagement letters are so very important both to the business health of the law practice and because they provide protection for the practitioner if a judgment over the amount billed is eventually sought.

The Impact of Technology on Legal Services Invoicing

Technology has had a huge impact on the legal industry, including legal services invoicing. With clients becoming consumers, they expect more from their law firms than simply the right legal advice. If they feel that their needs are not being met, they are more than likely to take their business elsewhere. Legal invoicing is the type of area that can easily be automated and managed using software. By the legal firm having invoicing software, they will be able to manage and automate the legal services invoices that they send out.

Legal invoicing software has many different features. For example, the system will allow you to develop hourly based legal invoicing, fixed fee legal invoicing, retainer legal invoicing and billing and even pro bono legal fees. The system is able to provide you with the legal services invoice on a monthly, quarterly, semi-annually or annually. The system will also allow you to add detailed descriptions to the invoices, which means that you will be able to break down the pricing in every invoice that you send out. You will be able to list how much time was spent and what it was you were doing for the client, such as researching or filing a form as well as your hourly fee per project.

One of the many benefits of legal invoicing software is that it allows for online payments. Most clients prefer to pay their legal fees online as it is much easier and quicker. The system will automatically send an email out whenever a new legal services invoice is generated. Online payments come in handy when you are providing retainer legal invoicing as these funds will be regularly used up.

Having the software in place will save your legal services firm plenty of time, which is essential when you have clients that don’t pay promptly. In some instances , with certain legal invoicing software, you can enable texts and emails to clients when the invoices from your legal services firm have not been paid by the time they are meant to have been. This feature will allow the client and the legal services firm to remain on the same page in terms of when the payment is due as well as making it easier for the legal services firm to keep track of the accounts receivable, which will allow you to maintain a strong cash flow.

Legal invoicing software will also make it easier for the legal services firm to send out the invoices and in doing so, there is no need for postage stamps to be bought and printed onto envelopes. Accounts with the legal services firm can easily be sorted out and in the case of legal invoicing software for retainer clients, the system becomes even easier to manage.

A lot of people look at legal invoicing software and think that there is no point or benefit to utilizing this type of software. However, if there is one thing that they are not taking into account, it is the fact that using this type of software will allow you to save time. Time, when it comes to running a business, whether it’s a legal services firm or not, is money and therefore time savings are always going to be beneficial.

Cloud accounting software is the key which will allow for legal invoicing to be effectively managed both online and offline. These systems will enable the legal services firm to track payments and expenses while being able to monitor cash flow and to manage client accounts. The software is straightforward to use and unless specified, does not require the whole firm to have the same software system and in doing so, allows the legal services firm to run smoothly and in turn, be a successful firm.